Imagine being tax-controlled after a cash deposit or seeing your savings seized at the borders … Cash, though convenient, is not without risk. What are the ceilings to be respected? What dangers exist when you keep too many tickets at home? Here’s everything you need to know to stay law and protect your money.

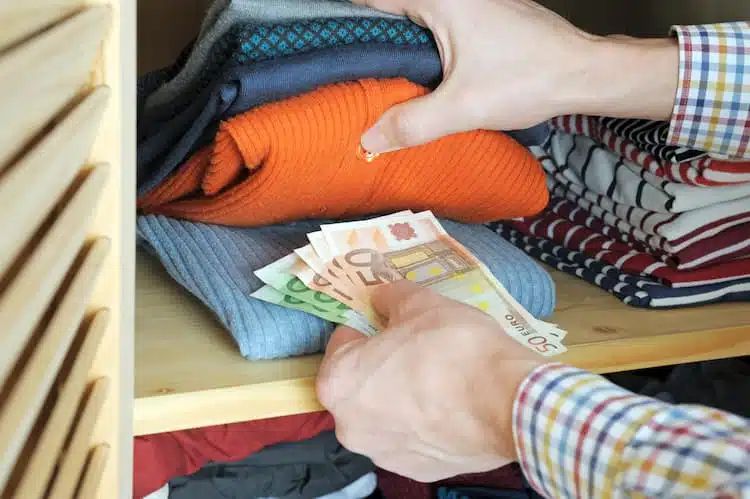

Keeping cash at home: myth and reality

Contrary to popular belief, there is no legal limit on how much money you can keep at home. You can keep several thousand euros without breaking the law. However, this freedom is accompanied by certain constraints.

First, if you deposit a large amount of cash into your bank account, your institution may require a justification of its origin. Banks are obliged to report suspicious transactions in the context of the fight against money laundering. Too large a deposit can therefore trigger tax control.

Then there are the material risks: flight, fire, water damage… your money can disappear in an instant. Without formal proof of the amount retained, no insurance will compensate you. Some opt for safes, but this does not protect against total losses in the event of a disaster.

Transporting liquid: strict rules to be followed

If keeping money at home is free, transporting it is regulated by law. You must declare to customs any amount in excess of EUR 10 000 in cash. This applies to travel both in France and internationally.

Why this restriction?

To combat tax evasion, money laundering and the financing of illegal activities. Failure to report such an amount may result in:

A fine of up to 50 per cent of the unreported amounts.

A possible total confiscation of money.

The authorities carry out random checks, in particular at the borders. If you carry a large sum without a declaration, it can be seized immediately.

Declaring liquidity online: an essential formality

The following page continuation